I get a lot of questions from people regarding identity theft, thanks to the long-running series I did on this blog regarding my client, Wendy Boka-Gonzalez, and our dealings with the IRS in trying to resolve a situation where her deceased husband’s identity was stolen.

I get a lot of questions from people regarding identity theft, thanks to the long-running series I did on this blog regarding my client, Wendy Boka-Gonzalez, and our dealings with the IRS in trying to resolve a situation where her deceased husband’s identity was stolen.

In Wendy’s case, it took 2 years, 3 months and 28 days (850 days total) for the IRS to resolve the problem. Obviously it’s best to avoid this situation. But what can the surviving relatives do?

Thankfully, Congress has now limited access to the Death Master File, which was the cause of much of the identity theft relating to deceased people.

And here are some additional tips from the IRS:

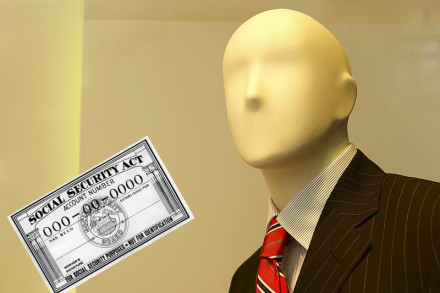

Each year, thieves steal the identities of nearly 2.5 million deceased Americans. The information below provides a few tips to reduce the risk of having a deceased person’s identity stolen:

-

Send the IRS a copy of the death certificate, this is used to flag the account to reflect that the person is deceased

-

Send copies of the death certificate to each credit reporting bureau asking them to put a “deceased alert” on the deceased’s credit report

-

Review the deceased’s credit report for questionable credit card activity

-

Avoid putting too much information in an obituary, such as birth date, address, mother’s maiden name or other personally identifying information that could be useful to identity thieves

For further reading on this website, check out these pages and articles:

[…] Dinesen, How to Protect a Deceased Person’s Identity. “Thankfully, Congress has now limited access to the Death Master File, which was the cause […]